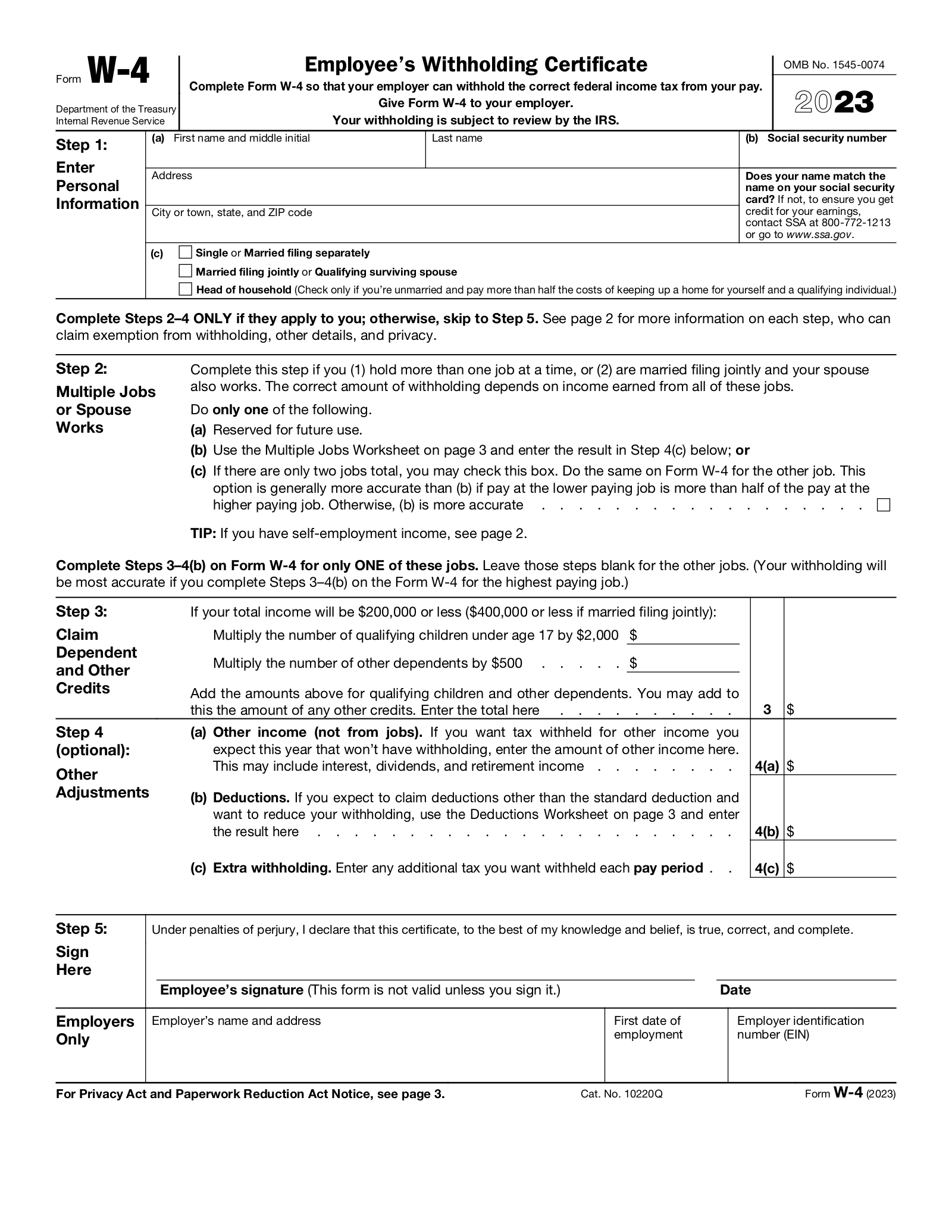

New W-4 Form For 2024 California – A Form W-4 is a tax document that employees fill out when they begin a new job. It tells the employer an updated version of Form W-4 for 2024, which can be used to adjust withholdings on . Starting an LLC in California will include the following steps: #1: Choose a Name for Your California LLC #2: Select a Registered Agent #3: File Your LLC Paperwork #4 to as Form LLC-1). .

New W-4 Form For 2024 California

Source : www.nerdwallet.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comFree IRS Form W4 (2024) PDF – eForms

Source : eforms.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comEmployee’s Withholding Allowance Certificate (DE 4) Rev. 53 (12 23)

Source : edd.ca.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comEmployee’s Withholding Certificate

Source : www.irs.govHow to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comNew W-4 Form For 2024 California W 4: Guide to the 2024 Tax Withholding Form NerdWallet: You’ll use Form SS-4 when applying for your EIN. All new businesses―except sole proprietorships―are required to register with the California 2021 to January 2024, new LLCs are not . As we enter the 2024 proxy season For updates relating to annual reports on Form 10-K (Form 10-K), please see our recent alert, Reminders for Preparing the Annual Report on Form 10-K. new Item 601 .

]]>