2024 Form 1040 Schedule C Instructions Pdf – However, a Schedule C form is required there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C, “Profit Or . Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a .

2024 Form 1040 Schedule C Instructions Pdf

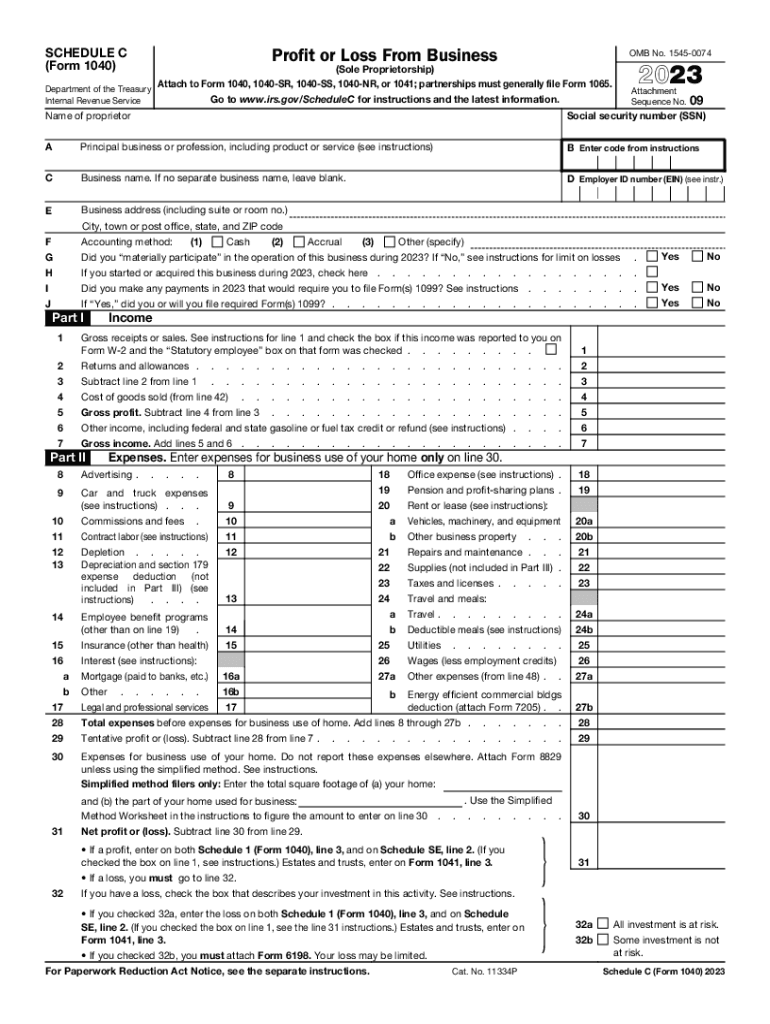

Source : irs-schedule-c-ez.pdffiller.comSchedule C (Form 1040) 2023 Instructions

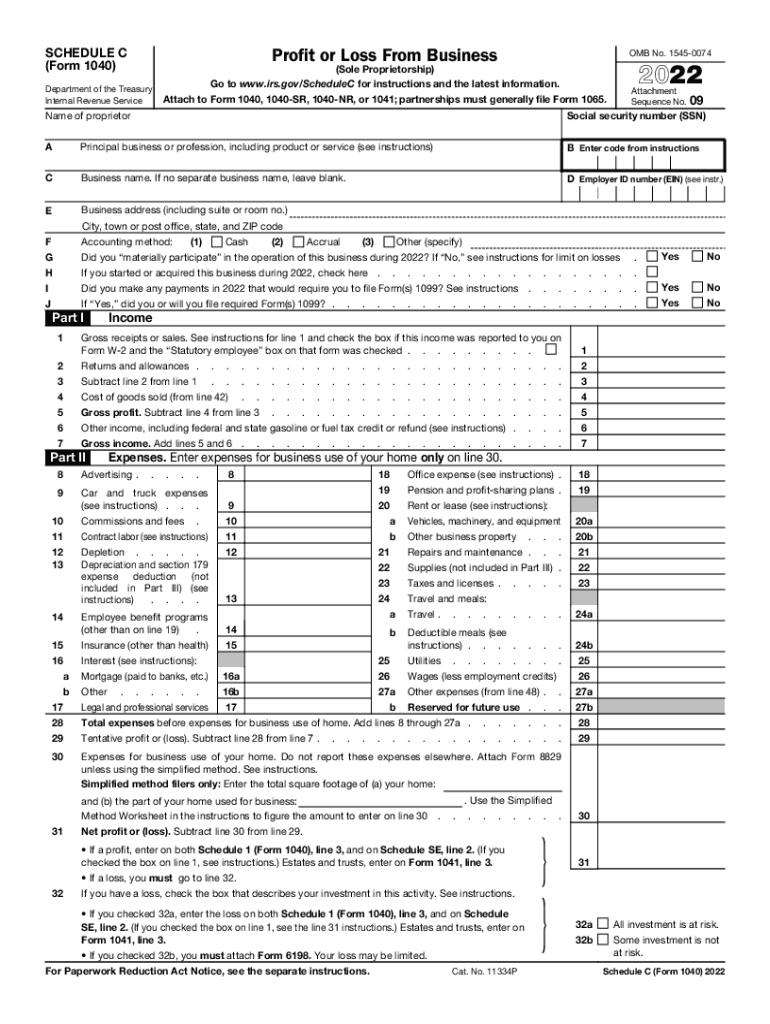

Source : lili.co2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov1040 gov: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govprofit or loss from irs form 1040 schedule c: Fill out & sign

Source : www.dochub.comSchedule C (Form 1040) 2023 Instructions

Source : lili.co1040 schedule c: Fill out & sign online | DocHub

Source : www.dochub.com2023 Instructions for Schedule C

Source : www.irs.gov2024 Form 1040 Schedule C Instructions Pdf 2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable : Gather each tax form you need to fill out for the type of business you own. Sole proprietors may only need the form 1040, Schedule SE for self employment taxes, and Schedule C-EZ for reporting the . or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 Line 1 as employment wages. The IRS ruled that cryptocurrencies are “property” in IRS Notice 2014-21 .

]]>